How I learned to stop building faster horse carriages and love disruption {Whitepaper}

17 June 2016 | Matthew Burgess

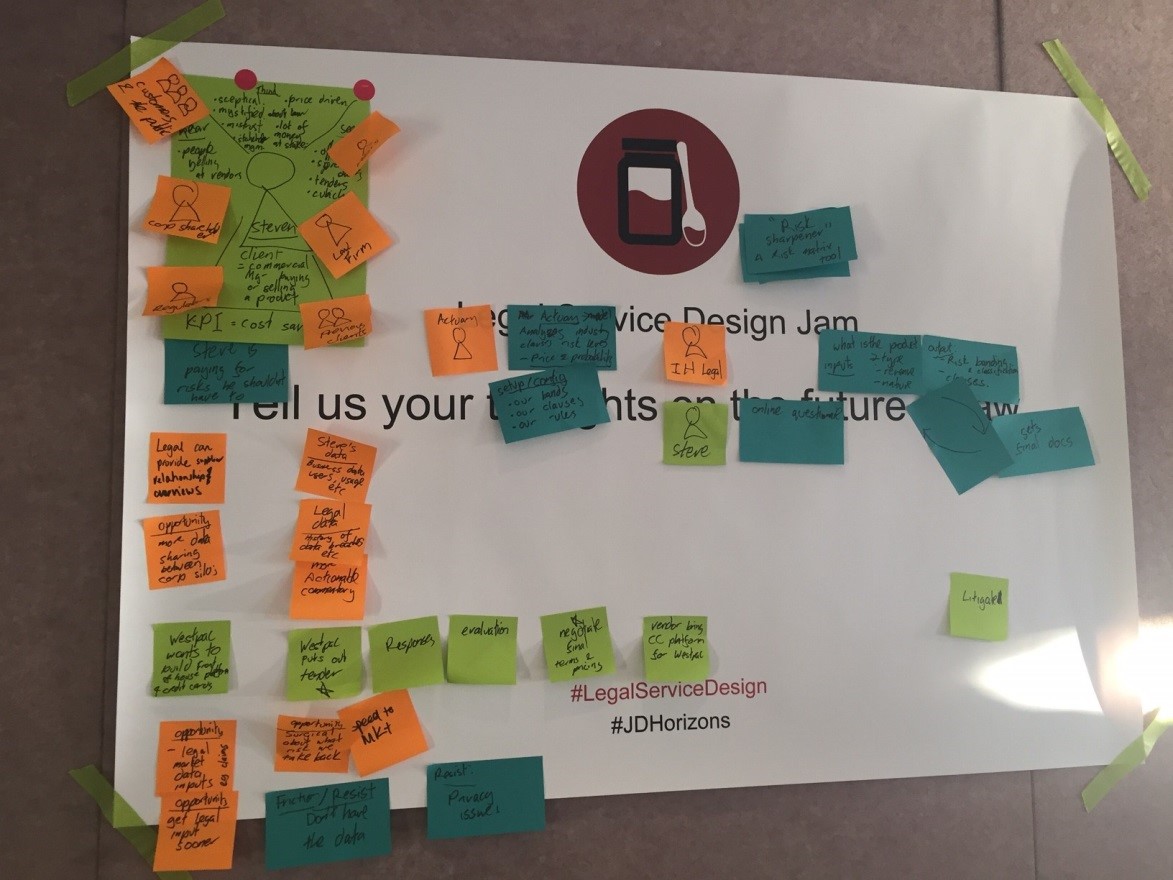

In July 2016, the first Legal Service Design Jam in Australia was held in conjunction with the Janders Dean Legal Horizons Conference at Pier One on the remarkable Sydney Harbour.

Those that were lucky enough to participate in the Legal Service Design Jam were challenged to build the best law firm in the world. Participants were split into three teams on the day: People and organisation, Legal process and Technology in the legal industry. The mission was to build a prototype for new models of doing business, and to do this in one day.

The Technology Team identified valuing legal risk as a key issue in the legal industry and one that could be solved with imagination and new ways of thinking.

Managing legal risk is incredibly challenging given the difficulty to accurately assess the impact and probability of a risk coming to fruition. This often means that valuing risk is mishandled which can become extremely costly to firms.

Warming up!

One of the "design thinking" techniques introduced by our facilitators from Cosquared

After a couple of warm up exercises we were fired up and ready to change law!

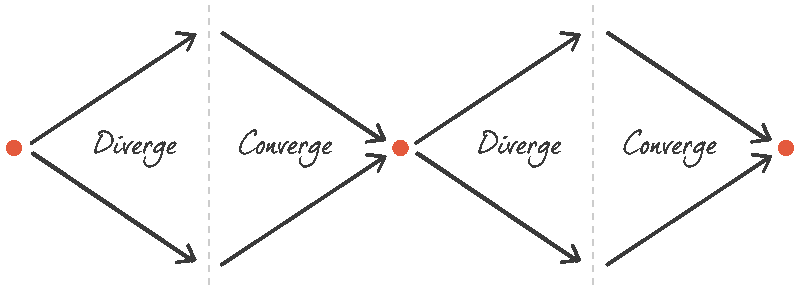

Generate Ideas:

Getting started - How can we make an impact?

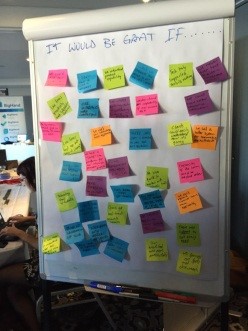

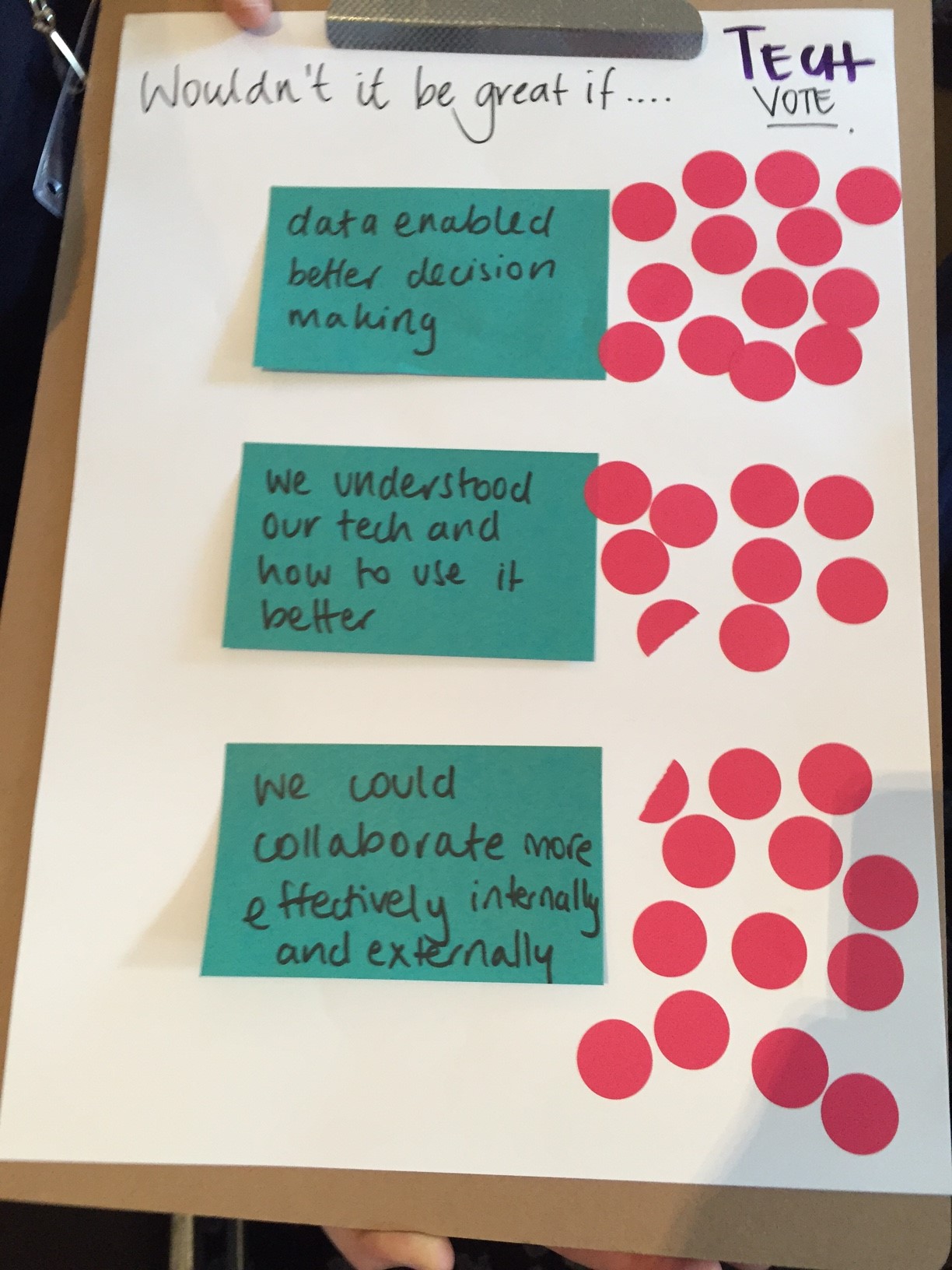

Soon, we had clusters of ideas to work with. During the break we asked other conference delegates for their perspective and asked them to prioritise our top three themes.

The people spoke with their dots!

We had a winner! We and the other delegates were fascinated by the potential for data to improve the way law gets done.

Our topic: "Wouldn't it be great if we could use data to make better decisions"

10 years ago in retail, everyone was scared of data. Now, you're dead if you don't use it.

- Sue Anderson, CoSquared facilitator

This prompted some interesting debate. What is holding legal back?

- Is it true that we don't use data? It is critical for some decisions but it was identified that it was not used as pervasively or with as much of a granular, systemised approach as is evident in retail.

- Is it a lack of tools or expertise? That's a factor.

- Is it fear? "No, we're not afraid, we just don't know where to start" concurred most of the team.

As we dug into the question of what is holding the legal sector back from using data to make better decisions, we needed a specific starting point. We tested a variety of examples of this problem and then decided to focus on a major factor that in-house corporate lawyers face on a daily basis.

The Challenge:

How does a commercial manager and corporate legal team put a value on legal risk to drive a better deal?

Now was the time to talk about the customer! We discussed a day in the life of Steve, a fictional commercial manager. What does Steve do, think, see or hear as he goes about his work? What are his challenges and priorities? How can we help? We mapped out his experience as he puts together a tender working together with the corporate legal team.

A day in the life of Steve (Commercial Manager). Empathy map and user journeys.

Soon the team got into solution mode. How could we actually build this? What do we need? What would it look like?

Introducing "The Risk Sharpener"

The Risk Sharpener is a technology platform for valuing legal risk. It takes a range of data sources. A law firm specialising in the area might build a historical dataset around previous cases and issues in the industry. The corporate team might add their own data reflecting their own internal experiences. There would also be a risk algorithm that weighted and combined various factors. It was identified that actuaries would be best suited to design the model. A level of industry consensus would be very helpful too. It wouldn't be easy, but surely it could be done!

Once the platform and model were up and running, Steve would need to add specific data related to the tender he is working on. For example if it was related to data security he'd need data about the number of potential users and the type of data in the system. The Risk Sharpener would be incredibly easy to use - it asks Steve questions, one at a time, until presto - he's done.

The results would be provided to the corporate legal team. The legal risk would be banded (green is good - red means run away!) to help them make decisions about the tender and contract details. It might even provide recommended clauses, tailored to this type of matter.

Finally, Steve and the legal team would be able to negotiate a better deal, taking on more risk themselves because they had a better understanding of their true exposure to legal risk on this tender.

The Risk Sharpener solution - in all its glory.

We also built the Risk Sharpener out of Lego. Why? Because lego of course!

So what are the biggest takeaways from the session?

- It was simply great fun to work with such an awesome team with such a diverse range of skills and experiences.

- The legal industry is diverse and complicated. It is exciting to create a solution for this problem but it is overwhelming to think about how many other data challenges legal professionals face today.

- We learned a huge number of techniques to facilitate the development of more effective, client-centric solutions to real-world problems. This is a great complement to the "Eureka Day", "Design Studio" and other continuous improvement programmes currently in use at LexisNexis.

Read more about the Legal Service Design Jam Sydney and 'How jam can reinvent the future of law'

And for more about the Jam's designs

Also, watch how the day panned out and what the participants had to say.

LexisNexis

LexisNexis